Tax Title Sales

Crescent City Title handles the resale of properties in Louisiana that are adjudicated through Civic Source, an online auction marketplace designed to get tax distressed properties back into the hands of the consumer. We issue title insurance policies underwritten through US National Title Insurance Company. Our policies cover any claims arising from the tax sale, as well as all claims covered by a standard title insurance policy.

The More You Know About Tax Title.

Few title insurance underwriters and agents offer affirmative coverage for adjudicated properties (properties adjudicated to a municipality or Parish for non-payment of property taxes). Historically, insuring title to adjudicated properties posed unique risks to the title insurer. One of the biggest risks involved includes, but is not limited to, original property owners filing a lawsuit against the municipality or Parish for failure to provide adequate notice prior to their property being sold at a tax sale, which said lawsuit could result in a reversion of title back to the original owner.

However, recent changes in Louisiana law have made it possible to insure title to adjudicated properties. Even in light of these changes in the law, not all title insurance underwriters will offer this affirmative coverage for the risks involved when purchasing adjudicated properties.

USNTI has agreed to issue the extra-hazardous risk endorsement, upon pre-approval of the Company’s Underwriting Department, for properties with unredeemed tax sales in its chain, whether purchased by a third-party at tax sale or adjudicated to the State or its political subdivisions pursuant to applicable law. The endorsement insures against loss sustained by an insured purchaser or insured lender caused by a final and effective judgment declaring the subject tax sale or subsequent conveyance by the State or its political subdivision to be invalid due to a constitutional violation regarding said tax sale or subsequent conveyance, including a lack of sufficient efforts to provide notice to anyone legally entitled to receive it. Also, this endorsement binds the Company to insure future sales, leases and mortgages of the property, subject to the Company’s ordinary underwriting processes, if a future purchaser, lessee or mortgagee purchases this endorsement along with an owner’s, leasehold or loan policy.

The rates for the endorsement are determined by the amount of the policy.

Please note that the tax sale endorsement will be required for every future sale for the next ten years in order to provide coverage to the new buyer.

FAQ

What is an adjudicated property?

An adjudicated property is a property which tax sale title has been acquired by a political subdivision pursuant to R.S. 47:2196. The original owner failed to pay taxes, the government was unable to sell the tax bill as a tax certificate at the annual tax sale, and the owner has subsequently failed to pay taxes the following five years.

I have heard these properties do not have clear title, is that true?

No. Prior to closing we work in conjunction with CivicSource to alleviate the title issues that arise in any closing. who clears up liens, mortgages, judgments and past taxes due on the property. The previous owners have been noticed that their taxes are delinquent and failed to capitalize on their final opportunity to redeem their past due taxes. By the time they are purchased, the legal requirements to sell adjudicated property in Louisiana have been met and you can feel confident the property you purchased was transferred legally.

Can the previous owners come back and cancel my purchase?

No. All tax sale parties were notified pursuant to La. R.S. 47:2206 or 2236 that their rights to the property were terminated by a failure to redeem the taxes owed. This notice, referred to as post sale notice in Louisiana law, was confirmed as constitutionally sufficient by the Louisiana Supreme Court in Central Properties v. Fairway Garden Homes, LLC. Previous owners of adjudicated properties retain the same rights as any other previous owner of property, the opportunity to file a law suit to attempt to nullify the sale off the basis of an illegality in the process.

How much does the tax sale endorsement cost?

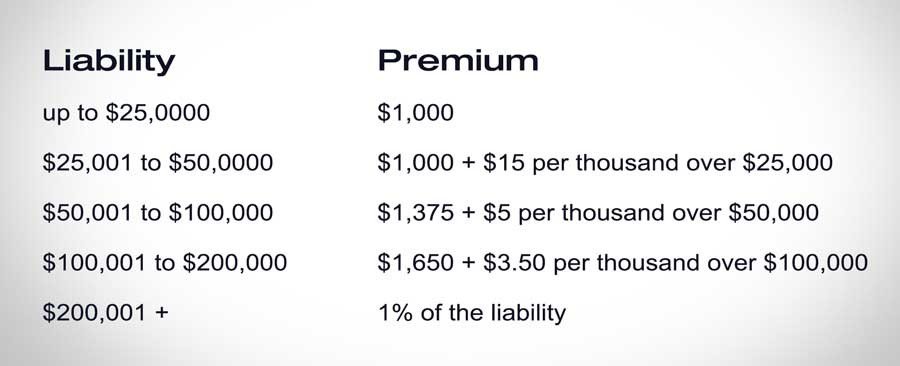

The title insurance premium is calculated just like any other title policy (filed rates with the LA department of insurance). The additional cost comes from two endorsements that affirmatively insure over the tax sale issue. The first is the tax sale endorsement. The premiums are calculated as follows:

Up to $25,000 – $1,000

$25,001 to $50,000 – $1,000 plus $15 per thousand over $25,000

$50,001 to $100,000 – $1,375 plus $5 per thousand over $50,000

$100,001 to $200,000 – $1,625 plus $3.50 per thousand over $100,000

$200,000 + 1% of the liability

The second is the ALTA 34 identified risk endorsement that costs 25% of the basic title insurance premium.

What does the sale of an adjudicated property confer to the purchaser?

An adjudicated property is a property which tax sale title has been acquired by a political subdivision pursuant to R.S. 47:2196. The original owner failed to pay taxes, the government was unable to sell the tax bill as a tax certificate at the annual tax sale, and the owner has subsequently failed to pay taxes the following five years.