Property Taxes

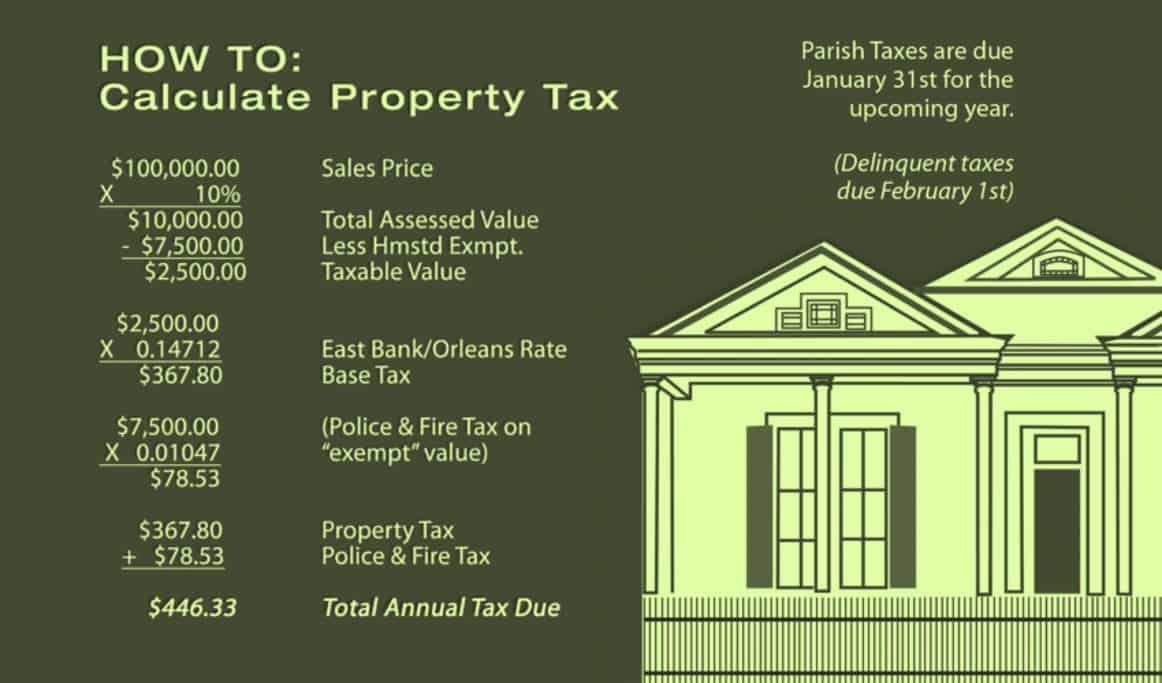

The Assessor is required by the Louisiana Constitution to list, value and enumerate all property subject to ad valorem taxation (of the levying of tax or customs duties) in proportion to the estimated value of the goods or transaction concerned, on an Assessment Roll each year. The Assessed Value is a percentage of “Fair Market Value” or “Use Value” as prescribed by law.

JEFFERSON PARISH 2023 |

|||

| AREA | WARD | RATE | CITY RATE |

| Gretna | 10 | 0.08275 | 0.06022 |

| Timberlane | 10 | 0.11135 | 0.03913 |

| Harvey | 40 | 0.13713 | 0.13382 |

| Harvey + Marrero | 40,41,42,43 | 0.13713 | |

| Westwego | 44 | 0.08275 | 0.03612 |

| 9 Mile Point / Bridge City | 45 | 0.13713 | |

| Avondale | 50 | 0.13713 | |

| Lafitte | 60 | 0.12565 | |

| Grand Isle | 61 | 0.12218 | 0.01284 |

| Jefferson | 70 | 0.13155 | |

| Old Metairie & Metairie | 81-82 | 0.13155 | |

| River Ridge | 91 | 0.12655 | |

| Kenner | 92 | 0.08153 | 0.01771 |

| Harahan | 93 | 0.08217 | 0.02193 |

ST. TAMMANY PARISH 2019 |

|||

| AREA | WARD | RATE | CITY RATE |

| Madisonville | 1 | 0.13231 | |

| Covington | 3 | 0.14224 | |

| Mandeville | 4 | 0.13376 | |

| Abita Springs | 10 | 0.14617 | |

| Slidell | 8-9 | 0.13709 | |

| Rural – Lee Road | 2 | 0.13455 | |

| Rural – Country Club & Riverwood | 4-8 | 0.13709 | |

ORLEANS PARISH 2020 |

|||

| AREA | WARD | RATE | CITY RATE |

| Eastbank | 0.14538 | ||

| Westbank | 0.14646 | ||

| Fire & Police | 0.01297 | ||