Real Estate Closings

The Three Main Tasks of Real Estate Closings:

- EVALUATE THE PROPERTY’S LEGAL, TAX AND FINANCIAL STATUS

Research land records and examine the property’s ownership timeline. - REMEDY OR MITIGATE ANY LEGAL DEFECTS

Provide legal counsel and execute necessary actions needed to clear title. - TRANSFER OF TITLE

Conduct a transaction, shifting ownership from one party to another.

Open & Process Title Order

An escrow or sales contract (agreement to close) starts the process by opening a title order that is then processed. Relevant tax information, loan payoffs, surveys, homeowner / maintenance fees, inspections/reports, and hazard and other insurances as well as legal papers are ordered and title commitments/preliminary reports are reviewed and sent out.

Examination & Title Search

Public records, such as deeds, mortgages, paving assessment, liens, wills, divorce settlements and other documents affecting title to the property, are searched. Title examination is the examination of the documents found during the title search that affect the title to the property. This is when verification of the legal owner is made and the debts owed against the property are determined.

Document Preparation

Review lender instructions / requirements, review instructions from other parties to transaction, review legal and loan documents, assemble charges, and prepare closing statements and set closing.

The Closing

Escrow/settlement officer oversees closing of transaction. Seller signs deed; buyer signs new mortgage; old loan is paid off; and new mortgage is signed. Seller, real estate professionals, attorneys and other parties to the transaction are paid. Documents are recorded in the county in which the property is located.

Post Closing

After the signing has been completed, the title company will forward payment to any prior lender, pay all parties who performed services in connection with the closing, and pay out any net funds to the seller before recording the documents with the parish. This all happens without any needed involvement from the buyer or seller.

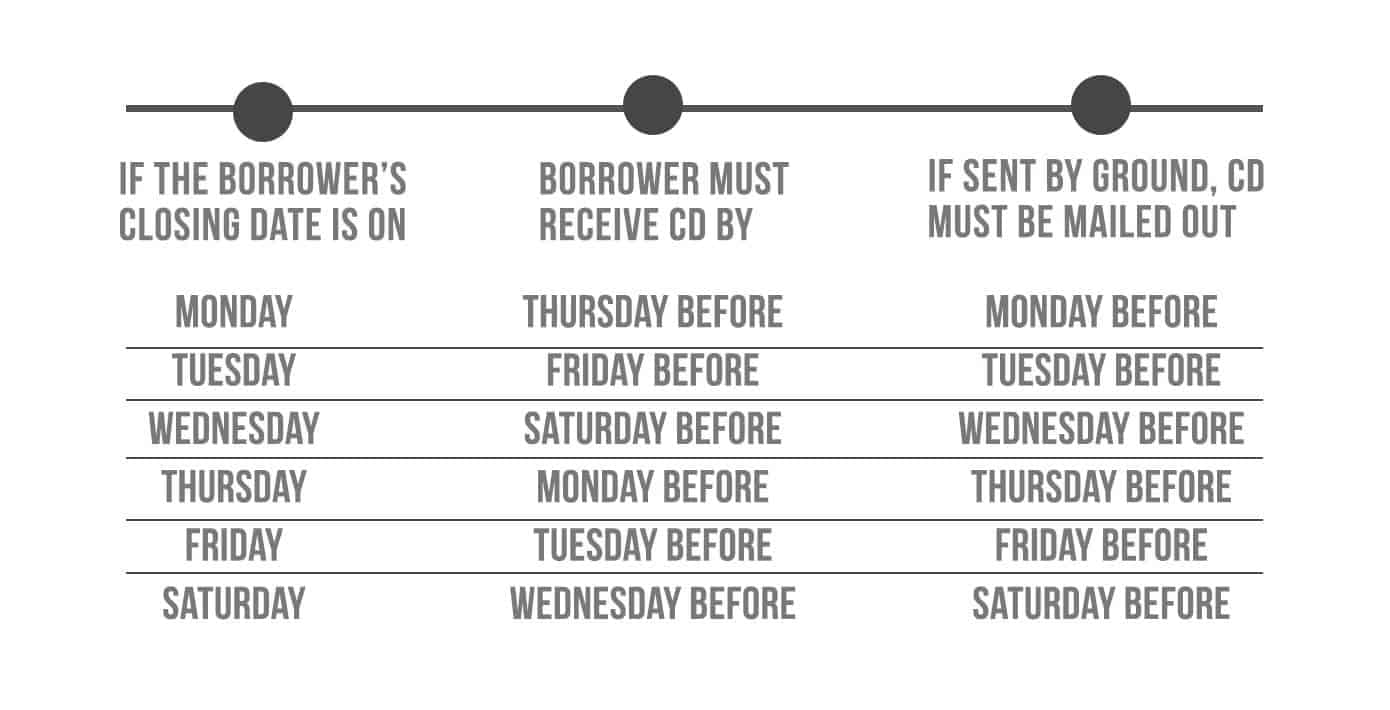

THREE DAY CLOSING DISCLOSURE (CD) TIMELINE RULE:

This Federal regulation placed on lenders can affect the date of a closing if not followed accordingly

What is the Closing Disclosure (CD)?

- The CD is a five page form with final details about the mortgage loan the borrower selected. It includes loan terms, the projected monthly payments, and how much the borrower will pay in fees and other costs to obtain the mortgage (closing costs).